Navigating the Future of Banking with Enhanced CX and Innovative Solutions

In the tapestry of banking's rich history, unwavering customer loyalty once was its crowning glory. Relationships spanning decades, if not lifetimes, were a testament to trust and mutual growth. However, in today's rapidly changing landscape, traditional banks are at a crossroads, grappling with competition from fintech, challenger banks, and neobanks. The core of this paradigm shift? The pivotal role of customer experience (CX).

Enhancing Customer Experience

Modern banking isn't just about offering financial services. It's about crafting an unparalleled, smooth, intuitive, and frictionless customer journey. But here's the rub: many banks barely scratch the surface in their pursuit of enhancing CX. They concentrate on dazzling digital interfaces while ignoring the back-end processes. Yet, the real magic happens when the front and back seamlessly blend, especially in platforms like ServiceNow, a digital workflow powerhouse. But, as with all things technological, challenges and bottlenecks lurk.

What Lies Beneath

While developing features, apps, and update sets on ServiceNow, it's not uncommon for development, test, and production environments to be misaligned. These disparities, seemingly minor, can have fateful outcomes. Consider an application or feature: meticulously crafted, flawless in a development instance, yet a production release spirals into chaos. The underlying villain? Environmental inconsistencies.

Cloning Isn't the Answer

Historically, the solution was cloning. In ServiceNow, this involves replicating an instance, like the production instance, into other copies used for development or testing. The goal was straightforward: create uniform testing and development conditions. But cloning, despite its merits, had its pitfalls. It demanded resources, time, and meticulous planning, with clones happening overnight or over weekends and ServiceNow pros spending days preparing the new clones for new work.

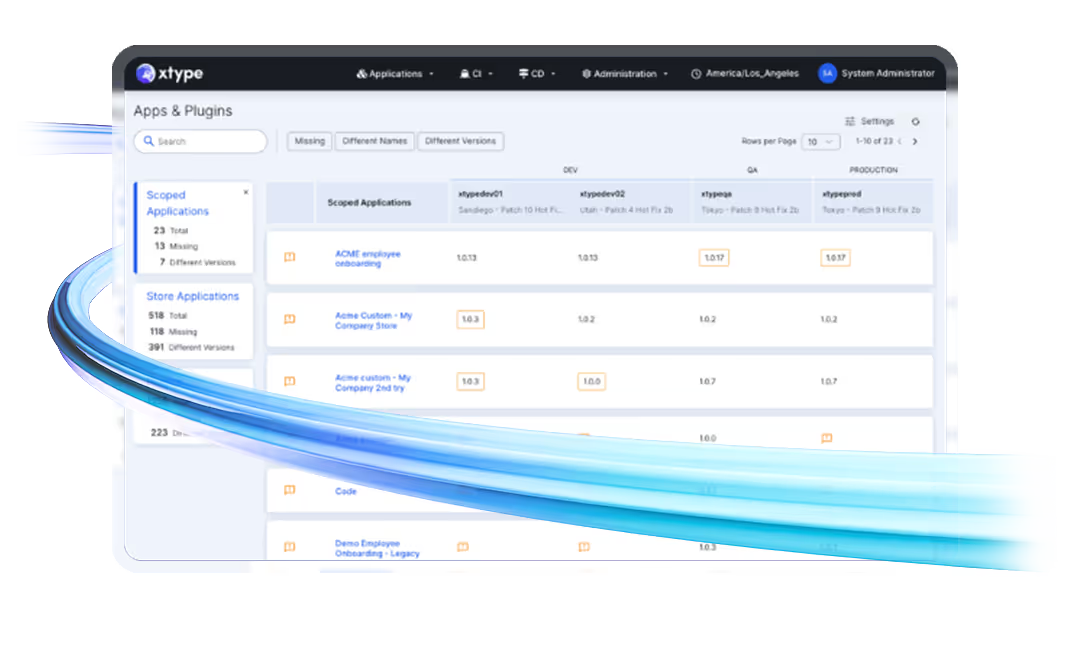

Multi-Environment Visibility & Controlled Synchronization

So, with the drawbacks of traditional methods, where does one turn? Enter xtype, a beacon in the quest for consistency in ServiceNow environments. xtype, with its cutting-edge ServiceNow products, isn't just a set of apps; it's a game-changer. xtype apps are designed to tackle environmental inconsistencies, providing an alternative to the rigmarole of cloning. It speeds up ServiceNow delivery, offering multi-instance visibility and synchronization with apps native to ServiceNow.

Empowering Swift CX Delivery

By integrating xtype into the Now platform, banks are poised to revolutionize their CX delivery. This integration allows for swift resolution of inconsistencies, ensuring smoother transitions and reduced glitches. Tools like xtype and xtype View serve as the eyes and ears for teams, uncovering disparities and streamlining processes. This clarity, in turn, empowers teams to channel their energies toward genuine innovation and impeccable service delivery in the banking sector.

Focusing on What Really Matters

To return to the broader picture of banking, the customer experience remains a critical touchpoint. The initial interaction, akin to a first impression, dictates the trajectory of future engagements. Customers today crave mobile-first, seamless experiences, especially in identity verification and money transfers. Recognizing this shift, leading banks have optimized their onboarding processes, integrating advanced technologies for a user-friendly experience.

However, the road doesn't end post-onboarding. Service delivery mechanisms need an overhaul. With xtype's prowess in zero-touch deployments, banks can ensure seamless services ranging from payments to loans. By navigating past the roadblocks of environment inconsistencies, banks can focus on what truly matters: customer-centric innovations and services.

Conclusion

To conclude, the banking sector stands at a pivotal juncture. The challenges are multifaceted, from rising competition to technological inconsistencies. But with tools like xtype on the Now platform, banks have the resources to navigate this complex terrain. The horizon beckons a new banking era characterized by impeccable CX, streamlined processes, and forward-thinking solutions. And as we move forward, it's evident that innovations like xtype will be instrumental in shaping the future of banking in the digital age.