How Financial Institutions Benefit from ServiceNow and xtype

Introduction

Financial institutions must be agile and responsive in today's fast-paced business environment to compete against challenging economic fluctuations. One of the ways they achieve this is by leveraging technology to streamline their operations and improve their services. The importance of technology became very apparent during the lockdowns of the 2020 pandemic. Your tech stack needed to adapt to a near-immediate explosion of remote workers, a change in the workflows to support remote work, supply chain challenges, and other business changes.

Russia's invasion of Ukraine provided another test of adaptability and resiliency for financial institutions as they shut down operations in Russia and sought to relocate their employees across the globe. The need for a tech stack that is both robust and adaptable has never been more critical than it is today and will be for at least the next decade. One technology and company that shined during these turbulent times has been ServiceNow.

ServiceNow, the Agile Tech Stack

ServiceNow offers various services to help organizations automate workflows, manage their assets, and enhance customer experiences. It is well documented that businesses relying on ServiceNow were able to produce new apps and services to meet the challenging and changing times we live in today. Mobile apps can be created within minutes rather than days, weeks, or months. Below, I explore why financial institutions look to ServiceNow for their operational needs and how xtype can be the x-factor to triple their ServiceNow output.

Improve Customer & Employee Experiences

Improve the cognitive power of your customer representatives and consultants by reducing or eliminating repetitive or semi-repetitive processes, including responding to common service inquiries. Freeing up this time will grant them to process more market information allowing them to make informed decisions and react rapidly to client needs. ServiceNow can provide financial institutions with self-service capabilities to resolve common issues, modify account details and automate financial analysis tasks.

Managing Risk and Compliance

To ensure seamless operations, it's crucial to integrate governance, risk, and compliance into every aspect of workflows. You can identify potential issues and proactively mitigate them by monitoring risks across all functions. With ServiceNow, you can create real-time reports and alerts to update you on potential risks and take necessary actions. Additionally, the platform can map your business services to underlying IT, people, facilities, and third-party vendors, allowing you to adapt to unforeseen circumstances. ServiceNow also automates the response to breaches based on their impact on your business and helps you keep up with regulations, manage change effectively, and reduce the cost of compliance.

Accelerating the Benefits of ServiceNow

I can provide more examples, but I can't overstate the significance of harnessing and broadening the usage of a dynamic software platform like ServiceNow. The sooner you onboard a tech stack, the sooner your teams are empowered to focus on more cognitive-heavy tasks. Shortening the Mean Time to Outcome positively impacts your capital investment and your ROI. ServiceNow is not just software; it's a strategic investment toward more efficient employees and a customer-centric future.

The Foundational Inhibitor to Benefit Realization

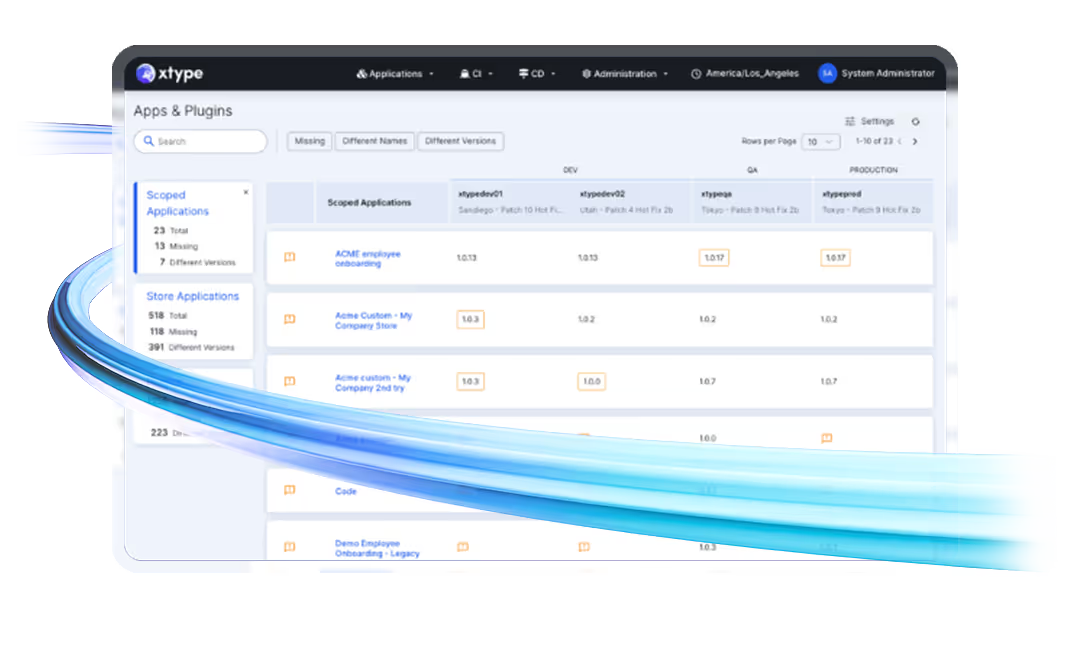

The biggest inhibitor to achieving accelerated benefit realization is environment inconsistencies. Inconsistencies between ServiceNow instances cause a significant productivity drag on your teams' ability to release requested features against a growing backlog. This productivity drag is due to ServiceNow pros having to troubleshoot collisions and conflicts arising from migrating developed changes from one instance to another. Cloning doesn't solve this problem because these same resources spend a lot of time in pre and post-clone efforts to preserve their work-in-process.

Of course, there's more unproductive but necessary work that cuts into productivity output that I could enumerate. Environment inconsistencies are one of the root causes of delayed delivery, a growing backlog, impaired quality, and even employee burnout. Financial institutions must deliver ServiceNow value at speed, and xtype is the solution to tripling your ServiceNow teams' output.

How xtype Accelerates ServiceNow Benefits

xtype is designed from the ground up to solve environment inconsistencies through several revolutionary capabilities built on the foundation of real-time multi-environment visibility and smart synchronization. xtype is changing how ServiceNow teams work and is a productivity multiplier to their output. With xtype, you can get more out of ServiceNow faster. Visit our website to watch a demo to learn more.